Financial KPIs

Whether you’re a Fortune 1000 enterprise or an ambitious startup, your success depends on generating revenue and responsibly managing your finances. Your stockholders, potential investors, and customers will use financial KPIs and ratios to assess the performance and viability of your business.

Current Ratio – Measures the ability of your organization to pay all of your debts over a given time period.

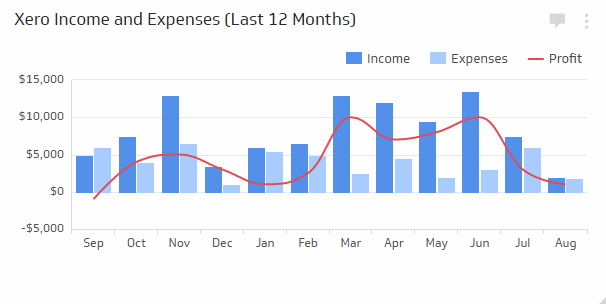

Profit and Loss Report – Measures your organizations net profit based on total income, cost of sales, and expenses.

Debt to Equity Ratio – Measures how your organization is funding its growth and using shareholder investments.

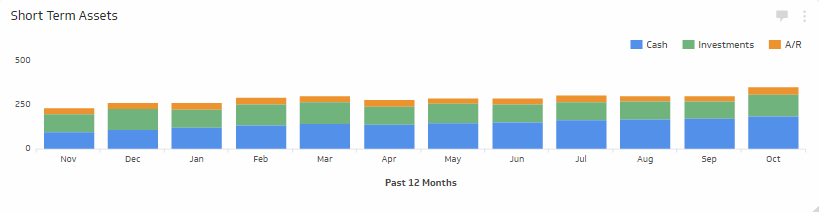

Working Capital – Measures your organization’s financial health by analyzing readily available resources that could be used to meet any short-term obligations.

Accounts Payable Turnover – Measures the rate at which your company pays off suppliers and other expenses.

Return on Equity – Measures your organization’s profitability by examining your ability to generate revenue for each unit of shareholder equity.

Recent Payments – This accounting KPI helps to track your most recent payments, which companies have recently paid, and how much these accounts have paid.

Quick Ratio / Acid Test – Measures the ability of your organization to meet any short-term financial liabilities, such as upcoming bills.

Current Accounts Receivable and Accounts Payable – Measures your current accounts receivable and payable and compares average debtors and creditors for the current and previous month.

Inventory Turnover – Measures how often you are able to sell off your in-stock inventory in a given year.

Vendor Expenses – This accounting KPI helps you track vendor expenses on an ongoing basis. Delve into individual vendor expenses and see the total for the time period of your choice.

Income and Expenses (Last 12 Months) – Measures your organizations profit over the last 12 months based on actual income and expenses.

Net Profit Margin – Measures how effective your business is at generating profit on each dollar of revenue you bring in.

http://www.klipfolio.com/sites/default/files/kpi_examples/net-profit-margin.png

Gross Profit Margin – Measures how much profit you make on each dollar of sales before expenses.